Switching things up slightly from this month going forwards, nothing major, don't worry. I'm just swapping around the finance and non-finance update. Over the past couple of years, as my numbers have compounded the numbers have mattered less and the lifestyle has risen to a priority. 2 months off work, again! Regular readers will know that I took 8 weeks Unpaid Parental Leave in 2025, taking off pretty much all of the school holidays to spend time with my kids. In January I've submitted the same again, and just had it approved (not that they can't not approve it, they can delay it under extreme circumstances but can't turn it down outright - see more in a previous post of mine here ). Lots of plans this year, so far we have booked a 2 week driving holiday in the French Alps, a long weekend in Salzburg, a biking holiday and Efterling in the Netherlands as well as a few days in Wales and the Peak District. Snowy Scarborough We had a night booked in Scarborough right a...

Finance update

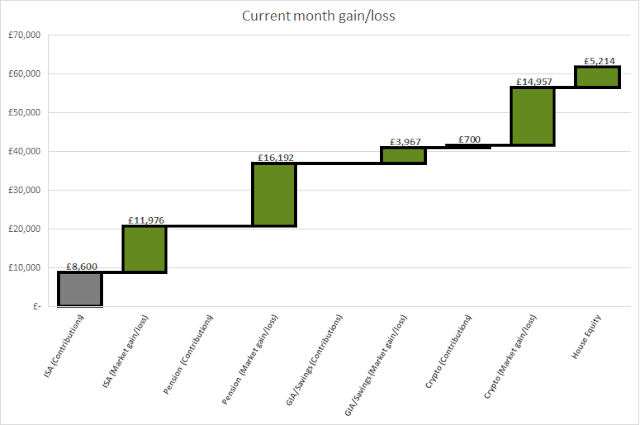

After three months of negative returns, my figures have bounced back in style! I've tracked my pots for just over a decade now and May was the biggest jump I've seen. It almost justifies chucking everything I did into the markets for the past 3 months both via my pension at the end of the tax year as well as into my ISA at the start of this tax year! Overall networth is now £1.2m

Breakdown for May:

- ISA up £12k

- Pension up £16k

- GIA/easy access savings up £4k

- Crypto up £15k

- House price up £5k

- Total: up £61.6k

Another good chunk into my ISA in May, which means it is now full for the year, the quickest I've ever done it! My priorities are now filling Premium Bonds, pound cost averaging into Crypto, and also contributing a few hundred a month into my kids JISAs.

2025/26 tax year:

Total change over the past couple of months is now +£36k.

Non-Finance update

- Unpaid Parental Leave

- No weeks off during May. The big 6 weeks off comes at the end of July!

- For more on this, see my seperate blog on Unpaid Parental Leave here

- Going through my photos and calendar there is not really much to report in May! My wife did her 2nd Marathon in a month and both me and the kids are really proud of her! We had a day out in Buxton catching up with family which was nice (the picture at the top is from my drone). There is lots of trips in June though so hopefully the next update will be a bit more exciting!

- We treated ourselves to a new - smaller - tent for some potential European adventures next year. Our current one is a 6-man, 23kg monster and takes up a lot of boot space. Whereas our new one is less than half the weight and size, and although it has a lot less porch space it should be fine for what we need it for. I also treated myself to a gadget that lets me play electric guitar in a matter of seconds instead of having to plug in amps and pedals, the Fender Mustang Micro Pro. I've played a lot more guitar over the past month as there's a lot less faff involved, and means I can just leave the device plugged in and hung up ready to go!

- Allotment / Foraging - Stuff is growing! Lots of gherkins, and potatoes that seem to have come from nowhere (I've had the plot for 2 years and never once planted a potato, but still they come!). I've been given lots of plants by my Mum to plant there as well, pepper, courgette, leek, tomatoes and purple sprouting brocolli, but I might have to squeeze some of them amongst the sheer amount of gherkin plants!

That's it, that's the update,

See you next time!

Well done on keeping calm with your roller coaster returns!

ReplyDeleteYou are lucky to have an allotment - I'd love one and reckon it would be worth its weight in gold for the food you can grow and the reduction in blood pressure a d stress!

My wife is getting really into hillwalking and whilst I'm slaving away at my desk, she's able to climb Munros.

I feel proud that I can help her achieve her goals - although like you I'm aiming to get a few weeks off this summer (maybe 2 months).

Keep writing.

Thanks, GFF

Thanks GFF! Yes there's a lot to be said for ignoring the short-term noise and sticking to the plan. I think my exposure to high risk assets (like Bitcoin) as well as crashes like Covid have toughened my resolve for such short term madness.

DeleteRe allotment, is there any council ones where you are, or - even better - any community led ones? The one near me was a toss up between the council one (waiting list of 3 years, £80 a year, need to supply all own stuff) vs the community one (no waiting list just luck, £30 a year, all stuff including seeds(!) supplied). I find it very good to have but got stung last year with the bad weather and lack of time to do weeding etc. Very good to expose the kids to though, any edible food I get from it I treat as a bonus really.

I read you recent post yesterday and the summer plan sounds great, fingers crossed that it falls nicely for you! If ever you find yourself near Leeds/Peak District then lemme know and we'll have to meet up! There's a few extra thoughts I had on your recent blog post but I'll comment directly on it rather than here :)

How did it feel when you broke the £1 million barrier ? Personally, it wasn't as significant as I thought it would be.

ReplyDeleteThe majority being locked away in house equity and pensions.

I found the key was to clear debt and imvest the money I was otherwise paying on debt repayment.

Avoiding lifestyle inflation also helped a lot.

Yeah it was a bit of an anti-climax! I made sure to mark the occassion by getting a bag of posh crisps and a tin of craft ale - whoa steady now!

DeleteSaying that, I think it's important to make these targets in the first place, and the at least measure and celebrate (however small the party!) when these targets are hit. Otherwise, it would just be 'saving for saving' sake and I don't think I'd be nearly as motivated towards that ambiguous goal as a line in the sand amount.

I think the more tangible an outcome, the bigger you feel the impact. A number on a screen makes no tangible difference for my day to day life, but it is what I can now do with that time that can make a difference. Maybe getting a cleaner once a week will free up my time to do other things, and things like applying for 8 weeks off via Unpaid Parental Leave has a very real tangible impact to my work/life balance for this year.

Avoiding lifestyle inflation is absolutely key to a FIRE strategy, and is something I've honed over the years. It also helps that I am an absolutely massive contrarian, so going a different path to 99% of society with regards to brands, fashion and big PCP loans also helps! Thanks for you comment :)