Switching things up slightly from this month going forwards, nothing major, don't worry. I'm just swapping around the finance and non-finance update. Over the past couple of years, as my numbers have compounded the numbers have mattered less and the lifestyle has risen to a priority. 2 months off work, again! Regular readers will know that I took 8 weeks Unpaid Parental Leave in 2025, taking off pretty much all of the school holidays to spend time with my kids. In January I've submitted the same again, and just had it approved (not that they can't not approve it, they can delay it under extreme circumstances but can't turn it down outright - see more in a previous post of mine here ). Lots of plans this year, so far we have booked a 2 week driving holiday in the French Alps, a long weekend in Salzburg, a biking holiday and Efterling in the Netherlands as well as a few days in Wales and the Peak District. Snowy Scarborough We had a night booked in Scarborough right a...

Finance update

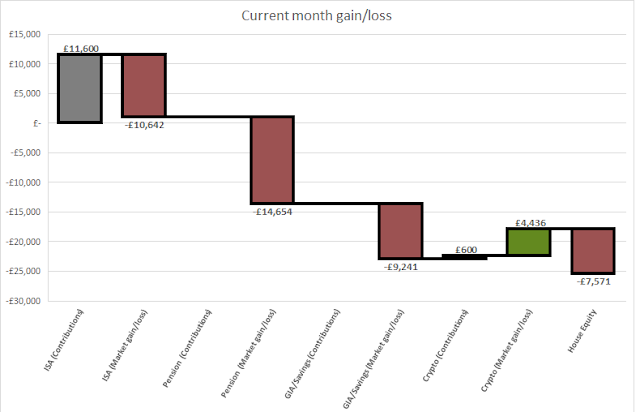

Third month in a row for negative returns with the reaction to the Trump tariffs taking full effect! Checking halfway through the month I was down £50k for the month, but in the end it was only half of this, down £25.7k

Breakdown for April:

- ISA down £10.6k

- Pension down £14.6k

- GIA/easy access savings down £9.2k

- Crypto up £4.4k

- House price down £7.5k

- Total: down £25.7k

You'll see a big chunk of money going into my ISA (grey bar), and I think I lucked out on the timing here. With the markets reaching the pit of the dip a day or two after the new tax year started. I'd imagine there's a few FIRE followers who have lucked out here, effectively buying the dip by moving money from cash/other savings into thei S&S ISAs.

My plan for the next month or so is to carry on ploughing into my S&S ISA. I'm expecting a tax relief rebate coming in that should cover off at least £5k of that. The quickest I have managed to fill my ISA has been June, and I'm on tracked to well and truly beat that this year.

After that here's my priority for where to put my money:

- ISA - fill to £20k

- Regular savings - fill to get £500 interest a year. I could increase this to £1000 but it's a risk in case I don't duck under £50k for the year

- Pension Contributions - enough to duck under £50k adjusted net income for the year. More on the various reasons I do this below.

- Crypto - carry on regular weekly buys (automated) of Bitcoin, Ethereum and Cardano of £50 each

- Premium Bonds and GIA - I currently only have £100 in Premium Bonds. I'm conscious that the prize chance has been reduced recently, but I think this is probably still the best place for the rest of the money.

- Other ISAs - wife's and potentially the kids JISA's (although I'm happy with what they're currently at)

At the moment my ISA will be full by the end of May. My savings is already at the £500 level (mix of Natwest regular saver, First Direct regular saver and a Chase easy access saver). For my pension contributions these will be sorted out next March towards the end of the tax year, so it looks like between June and March I'll be chucking what I can into Premium Bonds and/or my GIA.

Reasons to sacrifice all income above £50,271:

The most common way to 'sacrifice' income above £50k is to make additional pension payments, however there are other methods as well, including charitable donations. For full details see the government site on Adjusted Net Income

- Your Personal Savings Allowance (PSA) changes from £500 to £1000. Basic rate taxpayers get to generate £1k of interest per year, tax free. By

- You will receive more pension tax relief on any pension payments. Instead of receiving 20% basic tax relief, you will get 40% tax relief on any pension payments. This is slightly more if you do it via a salary sacrifice scheme (42% vs 32%).

- You get to retain your Child Benefit by swerving the High Income Child Benefit Charge. This is one that sometimes gets overlooked, and whilst it is not a tax in the traditional sense of the word, it is a benefit linked to your income level. So effectively it works out as a taxable benefit for the purpose of this. If you or your partner claim Child Benefit, it is tapered away when one partner’s adjusted net income exceeds £60,000 (and is fully withdrawn at £80,000). You can effectively earn £80k, and make £20k pension payments and retain your full child benefit for the year. You don't need to sacrifice to below £50k for this to work, although the above benefits still apply. To make this one easier to understand I've made the below graphic which factors in the taxable benefit depending on how many children you have. The taxable benefit is more for the first child (6%) and less for each additional child after this (4.1%).

- Example: A person with 2 children earns £80k. Everything they earn between £60-80k will attract a marginal tax rate of 52.40% (40% income tax, 2% NI, 6% HICBC child 1, 4.1% HICBC child 2).

- When the Child Benefit taper was lower and more concentrated (£50-60k), it used to be that your effective tax rate between £50-60k would be 70% if you had 3 children! Since it changed it is more spread out and less drastic, but still relevant.

Non-Finance update

- Unpaid Parental Leave

- I had a week off for Easter school holidays

- For more on this, see my seperate blog on Unpaid Parental Leave here

- Trips

- Sherwood Forest

- We spent a couple of nights at a place close to Sherwood Forest, my wife had a 20 mile run in preparation for her marathon, and I took the kids out on some of the many excellent cycle trails around the forest.

- Easter travels

- The weather was absolutely fantastic for the first week of the kids Easter holidays, and I lucked out with that being the week I chose to take off work (UPL). The kids had some friends over, and I took them out to explore the woods, paddle in the water and it also meant that I could collect another haul of wild garlic!

- We travelled to see my sister's newborn niece

- We went into Leeds to see the jousting at the Royal Armouries. Very entertaining and extremely good value for money with tickets being £5 each. The kids got given a leaflet about the knights competing, with space for the autographs afterwards. Nice touch!

- Other things:

- Allotment / Foraging - I've spent a bit of time sorting my allotment out, the gherkin plants are now in, the rhubarb is thriving and there's even potatoes growing that the previous owner seemed to have planted over 2 years ago. Still making quite a lot with the wild garlic, pesto and scones, lovely! At Easter we travelled down to Saffron Walden, and I was shocked to see it on sale at the market for £6 a bulb!!!!

- Bike rides - Sherwood Forest was the big one, we've also been to Rother Valley Country Park and St Aiden's Nature reserve as well. I'll be keeping my cycle racks on top of the car for the rest of the summer now, so it's easier to just decide to go out for a ride.

That's it, that's the update,

See you next time!

Comments

Post a Comment